Monthly Blog- March 2024

Abidjan continues to impress me, the level of infrastructure and improvements to the city over the last 10 years is really encouraging. We are here on several projects – a lease renewal, advising on a new headquarter development and an African portfolio optimisation, valuing a logistics park and finishing off the acquisition of a new embassy.

James Charnaud

Abidjan continues to impress me, the level of infrastructure and improvements to the city over the last 10 years is really encouraging. We are here on several projects – a lease renewal, advising on a new headquarter development and an African portfolio optimisation, valuing a logistics park and finishing off the acquisition of a new embassy.

You can sense the positive vibe from the recent hosting (and winning) of the African Cup of Nations by Cote D’Ivoire. Flags are still on the cars and I have never seen so many replica football shirts.

The office market has heated up, prior to 2020 prime rents were always easy to quote “XOF 10,000 per sqm per month”. Then this ceiling was broken and today new or newly refurbished space is achieving XOF17,500 – 20,000 per sqm per month. The Groupe Duval Office Building is now starting to charge for car parking which has traditionally been included in the rental rate in Abidjan. Other landlords have heard of this and are now openly quoting it to us in our negotiations.

The industrial / logistics development has traditionally been around parts of Macory, the Port and Yopougon. Now, new areas are emerging. These are driven by a lack of decent sized units and road improvements. We were involved in a valuation around PK24. A couple of years ago there was some development but we were mainly offered land for sale which was being bought up by speculators. Now you can see the construction of the Y4 Ring Road is in progress and industrial units are being constructed and land purchased by occupiers. Drive off the main Auto Route Du Nord and you will be amazed at how many large plots have been sold to corporations who are looking to build or are building factories. The price of land has doubled in the last 18 months and the early speculators are reaping the benefits. Rental rates for quality warehouse units are in the €6.75 per sqm per month level with some developers now quoting rates above €7.00 per sqm per month for future delivery.

Monthly Blog- February 2024

This month I travelled to the historic city of Bern, the place where Albert Einstein famously began to develop his Theory of Relativity. The story goes that Albert Einstein was riding on a tram in Bern, Switzerland, during his time working as a patent clerk in the city. As he looked out of the window, he saw the Zytglogge, a prominent clock tower in Bern's old town.

Charles Whitmee

This month I travelled to the historic city of Bern, the place where Albert Einstein famously began to develop his Theory of Relativity. The story goes that Einstein was riding on a tram in the city during his time working as a patent clerk. As he looked out of the window, he saw the Zytglogge, a prominent clock tower in Bern's old town.

As Einstein watched the clock tower, he began to ponder the nature of time. He imagined what it would be like to ride alongside a beam of light as it travelled through space. This thought experiment led him to question the classical understanding of time and space, which had been largely defined by the work of Isaac Newton.

Hoping for a similar degree of sublime inspiration from the city, I arrived at Bern central train station and began my project- a residential market analysis and search for a new ambassadorial residence.

The market for residential real estate in Bern is characterized by a notable lack of supply. This applies across the spectrum but is particularly notable at the upper end of the market. All the local agents and experts with whom I consulted mentioned that properties generally will be bought very soon after coming onto the market and achieve their asking prices.

In fact, the high-end market is driving much of the price growth in the city, with unfavourable financing conditions dampening the lower ends of the market. This, combined with limited supply of new or second-hand houses coming onto the market has created a steady upward pressure on prices. According to the Swiss bank BEKB, house prices in the canton of Bern increased by 3.5% in 2023 but this figure jumps to over 9% when looking specifically at the Kirchenfeld neighbourhood, for example.

Kirchenfeld has a reputation for being the most desirable neighbourhood in Bern. It is located across the Aare river from the main area of Bern and has the character of a quiet suburb despite its proximity to the city centre. The average price for houses in Kirchenfeld is CHF 9,454 per square metre, and CHF 10,752 per square metre for apartments. Over recent years, the surrounding neighbourhoods of Sandrain and Brunnadern have grown in popularity and have achieved relative parity with Kirchenfeld regarding prices. Other areas of the city which are becoming increasingly popular with high-income individuals include the northeastern suburbs of Spitalacker, Breitenrain and Lorraine.

Monthly Blog- November 2023

EMC RE’s goal is to provide real estate services to a western-level of quality across the world. We are confident that we have unrivalled experience and expertise in the most challenging markets and to date we have worked on-the-ground in 141 countries.

EMC RE’s goal is to provide real estate services to a western-level of quality across the world. We are confident that we have unrivalled experience and expertise in the most challenging markets and to date we have worked on-the-ground in 141 countries.

November saw us travel to 10 countries across Africa and Europe:

Cyprus to undertake valuations of two HQ building in Nicosia and Limassol for sale and lease back purposes.

Portugal negotiating a new lease for a government client in Lisbon.

Romania negotiating a new lease on a prominent residential property in Bucharest

Armenia to undertake a site search for a new HQ office building.

Montenegro to value an Embassy and diplomatic residence.

Morocco to carry out valuations in Rabat, Casablanca and Marrakech for both a government client and a private family estate.

Burkina Faso to value an apartment complex in Ouaga 2000.

Cote D’Ivoire to search for a new Embassy site in Cocody and to also finalise a lease renewal in Plato, Abidjan.

Ghana to carry out a feasibility study on a 50 acre site in Tema and undertake negotiations for the acquisition of a new office building.

Sao Tome and Principe to finalise the acquisition of a client’s new office.

December is looking like another busy month of travel….. we might even increase the tally of countries we have worked-on-the ground in to 142!

Residential market- Asmara, Eritrea

We were instructed to undertake a review of the residential market in relation to the leasing of a high-end villa in Asmara, the capital of Eritrea.

We were instructed to undertake a review of the residential market in relation to the leasing of a high-end villa in Asmara, the capital of Eritrea.

I flew from the UK to Addis Ababa and then on to Asmara. The planes were pretty much full and a good number of persons and families travelling to Asmara had boarded at Heathrow with me. Visitors to Asmara are almost all Eritreans returning home or visiting family.

Whilst one might expect it to be very hot, the climate in Asmara is in fact quite mild, being the sixth highest capital city in the world. As is normal in this market, the house that I visited had no air-conditioning, but did have open fires (not necessary at this time of year but it can get quite cold).

The city is relatively quiet and totally hassle free in my experience. Eritreans are friendly and helpful. Traffic is light and it is easy to get around using local taxis, although finding places can be a challenge even with a local, as is normal in a lot of African markets.

There are some unusual aspects to visiting as a foreigner to Eritrea, which used to be relatively common in Africa, but which one comes across rarely nowadays:

Credit and debit cards are not accepted so it is cash-only. I bought US Dollars with me and made sure that they were unmarked and pristine, but still got caught out by a rule that banks in Eritrea will not accept notes dated pre-2006.

The place is also extremely challenging from a communications point of view. The internet is very weak and unstable even in the best hotels. International SIM cards do not work in the country, and there is no 3G network.

There is little tourism in Asmara, but many that come here do so for the city’s architecture, as there are some iconic and exceptional art deco and futurist buildings dating from the period when the Italians were in Eritrea. The old Fiat garage is a beautiful thing to see, and I have included a photo that I took of it below.

In relation to the assignment and the real estate market there has been little construction in Asmara since before the Ethiopia-Eritrea war. Around the new Chinese Embassy to the north of the airport there are hundreds of apartments in blocks where construction has stopped and apparently abandoned.

There is very little on-line regarding the market, and no leasing or sales boards to identify availability when you are on the ground. Much of the market is word-of-mouth and there are no estate agent offices to visit, although there are individuals that operate as brokers at street level.

I used a combination of local business contacts, intermediaries and basically everyone sensible who I met to learn about the market and identify availability.

My target areas were the best residential locations in town comprising Tira Volo and Campo Bolo, where pricing for the highest quality residences is as follows:

4-5 bed villa with good-sized garden $4,000 /month

3 bed villa with limited outside space $2,500 /month

3 bed apartment (e.g. Alpha Building, Blue Building) $800 /month

Availability of water on-site and water storage capacity is a big issue in Asmara, and this is one of the reasons for the relatively low pricing of apartments (quality also being a factor). When you view properties, owners are always keen to explain the below-ground and above-ground water capacity.

We provided the client with a full report on the market including a review of the practices relating to leasing which are quite prescriptive (for commercial as well as for residential), and we will be moving forward now to a transactional phase for this project.

For further information please contact James Whitmee: jwhitmee@emc-re.com

Fiat Tagliero in Asmara - stunning futurist former garage

Romania and Moldova in July

We were fortunate recently to be able to combine two assignments within a single trip covering Bucharest, Romania and Chisinau, Moldova.

We were fortunate recently to be able to combine two assignments within a single trip covering Bucharest, Romania and Chisinau, Moldova.

Flying in to Bucharest it doesn’t take long to realise that local taxi drivers don’t charge local rates to foreign visitors but fortunately the city has a very good underground system which we were able to use to visit various part of the city both cheaply and easily.

Our assignment here was to advise on a lease renewal for a government client. The property was located in the Primaverii / Dorabanti district which is a prime residential area with many large villas and an area favoured by diplomatic missions.

As usual our research included several hours of legwork, walking around to understand the location of the property within the area and to familiarise ourselves with the nature of the neighbourhood. We then met with several agents active in the market to not only identify comparable properties but also to understand where the market currently stands and what factors are currently influencing the market.

After making adjustments to reflect various factors we were able to apply the comparable evidence to the subject property to obtain our estimate of the market rent. We then subsequently met with the landlord organisation to discuss the lease renewal and also to raise various issues which the client required to be addressed at the property. The meeting was successful and we are now in the process of progressing the lease renewal.

Due to Chisinau’s close proximity to Ukraine there are currently limited flights so we opted to take the train from Bucharest. Despite the two cities being only c.360 kilometres apart the journey was 13 hours on a sleeper train which turned out to be a remnant from the Soviet era and which felt very much like a trip back in time with the carriages certainly not being affected by any modernisation.

Our assignment in Chisinau was to update the valuation of a city centre land plot for another diplomatic client. We had information on comparable land sales and listings but a major factor is the planning designation of each of the lands.

It is common in emerging markets for specific planning designations to be lacking and for regulations to be poorly enforced. However in Chisinau there is now a designation for every land plot and planning regulations are now being more strictly enforced leading to a greater impact on value.

We have successfully completed a number of assignments in Chisinau and have a very good local company that we work with in this market. As a result we were able to obtain access to planning designation details and also a document detailing the development permitted for each of the individual planning designations.

Having obtained all the required information, it was off to Chisinau station where there were three destination options shown on the departures board – Kyiv, St Petersburg and Bucharest. We chose Bucharest and a flight home where in the following week we successfully completed and submitted our update valuation report to the client.

For further information please contact Michael Lowes mlowes@emc-re.com

Case study: Duqm, Oman

In September 2022, EMC Real Estate was instructed by an oil & gas major to carry out real estate consultancy services on an industrial port in South East Oman called Duqm, located 800 km south of Muscat.

In September 2022, EMC Real Estate was instructed by an oil & gas major to carry out real estate consultancy services on an industrial port in South East Oman called Duqm, located 800 km south of Muscat. Fortunately, I was given the opportunity to carry out the assignment and visit Oman for the first time. As soon as I landed and with a few hours to kill, I headed to the Old Quarter of Muscat, where I visited the Bait Al Zubair Museum, which houses one of Oman's largest art and permanent collections, a window into Omani heritage and culture. Afterwards I visited the old Souk and bought some customary frankincense and rose water.

The assignment was to provide an initial market & strategy report in the context of a potential acquisition of 50 hectares of land at Duqm Port. The salient points of the report included:

Market overview specific to the location.

Rental levels and likely market terms.

Likely contracting strategy, duration, ground lease, option agreements etc.

Negotiating strategy to secure the land as quickly as possible, without disclosing the name of the client.

The scope, timeline, and cost to manage the acquisition.

The client’s intention was to secure the land with the maximum possible future flexibility in terms of both use and duration (e.g. break clause).

With site seeing out of the way, my first 48 hours in Oman were spent in Muscat, where I attended several meetings with various stakeholders including but not limited to:

Asyad HQ: Oman’s global integrated logistics provider, ranked 4th on Forbes’ “10 Biggest Logistics Companies in MENA” list. As a government company, Asyad Group is the logistics arm of the government in Oman.

OPAZ, (Public Authority for Specialist Economic Zones & Free Zones).

Savills property consultancy.

Port of Duqm HQ.

After two days of meetings in Muscat, I caught the daily red eye flight to Duqm, where I met the Port Authority and the general manager of the ASYAD terminal which was already operational. They gave me a tour of Duqm Port but was refused access to a section of the port where the 50 hectares of subject land was located.

Despite having received clearance from the Port authority in Muscat, this section of the port was operated by OTTCO (Oman Tank Terminal Company), whom it turned out had not been informed, and had their own separate security clearance protocol. It took me 24 hours to convince them to allow me to enter and appraise the subject land. The fact that there was a US Navy warship docked at the ASYAD terminal, didn’t help matters, as the security across checks were even more rigorous.

On returning to Muscat, I met with the principal of OTTCO, who agreed in principle to lease or sell the 50 hectares of land that our client had identified for industrial and shipping purposes. We agreed the next phase of the project would be to introduce our client so that they could explain the project in more detail as EMC had signed an NDA, so we’re not permitted to disclose who our client was, or what their exact intentions were for the land in question.

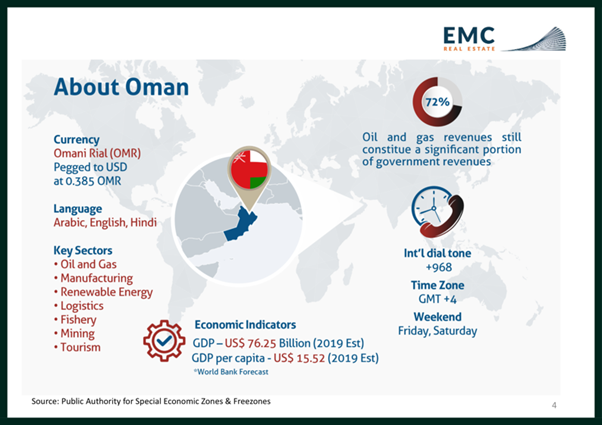

Key facts about Oman

Key projects and operators

ACME (Green hydrogen project) have acquired a 50-60 sq km piece of land for renewable energy (wind & solar) and are developing a further piece of land for an electrolyser

DEME (Belgium company) in partnership with OQ, also doing a green hydrogen project

Duqm refinery is joint owned by OQ & the government of Kuwait (OQ8)

Renaissance Village: 17,000 beds in Duqm – 6 rials ($15.5) per day per person / x 6 in a room – includes accommodation, laundry & food

Airport: no international flights yet. Talk of Doha – Duqm flight before Covid