Case study: Duqm, Oman

In September 2022, EMC Real Estate was instructed by an oil & gas major to carry out real estate consultancy services on an industrial port in South East Oman called Duqm, located 800 km south of Muscat. Fortunately, I was given the opportunity to carry out the assignment and visit Oman for the first time. As soon as I landed and with a few hours to kill, I headed to the Old Quarter of Muscat, where I visited the Bait Al Zubair Museum, which houses one of Oman's largest art and permanent collections, a window into Omani heritage and culture. Afterwards I visited the old Souk and bought some customary frankincense and rose water.

The assignment was to provide an initial market & strategy report in the context of a potential acquisition of 50 hectares of land at Duqm Port. The salient points of the report included:

Market overview specific to the location.

Rental levels and likely market terms.

Likely contracting strategy, duration, ground lease, option agreements etc.

Negotiating strategy to secure the land as quickly as possible, without disclosing the name of the client.

The scope, timeline, and cost to manage the acquisition.

The client’s intention was to secure the land with the maximum possible future flexibility in terms of both use and duration (e.g. break clause).

With site seeing out of the way, my first 48 hours in Oman were spent in Muscat, where I attended several meetings with various stakeholders including but not limited to:

Asyad HQ: Oman’s global integrated logistics provider, ranked 4th on Forbes’ “10 Biggest Logistics Companies in MENA” list. As a government company, Asyad Group is the logistics arm of the government in Oman.

OPAZ, (Public Authority for Specialist Economic Zones & Free Zones).

Savills property consultancy.

Port of Duqm HQ.

After two days of meetings in Muscat, I caught the daily red eye flight to Duqm, where I met the Port Authority and the general manager of the ASYAD terminal which was already operational. They gave me a tour of Duqm Port but was refused access to a section of the port where the 50 hectares of subject land was located.

Despite having received clearance from the Port authority in Muscat, this section of the port was operated by OTTCO (Oman Tank Terminal Company), whom it turned out had not been informed, and had their own separate security clearance protocol. It took me 24 hours to convince them to allow me to enter and appraise the subject land. The fact that there was a US Navy warship docked at the ASYAD terminal, didn’t help matters, as the security across checks were even more rigorous.

On returning to Muscat, I met with the principal of OTTCO, who agreed in principle to lease or sell the 50 hectares of land that our client had identified for industrial and shipping purposes. We agreed the next phase of the project would be to introduce our client so that they could explain the project in more detail as EMC had signed an NDA, so we’re not permitted to disclose who our client was, or what their exact intentions were for the land in question.

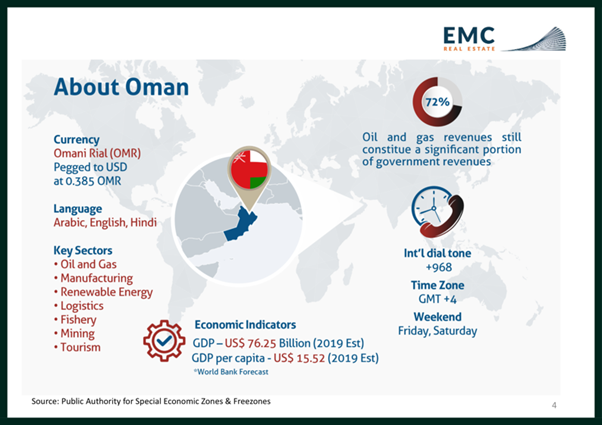

Key facts about Oman

Key projects and operators

ACME (Green hydrogen project) have acquired a 50-60 sq km piece of land for renewable energy (wind & solar) and are developing a further piece of land for an electrolyser

DEME (Belgium company) in partnership with OQ, also doing a green hydrogen project

Duqm refinery is joint owned by OQ & the government of Kuwait (OQ8)

Renaissance Village: 17,000 beds in Duqm – 6 rials ($15.5) per day per person / x 6 in a room – includes accommodation, laundry & food

Airport: no international flights yet. Talk of Doha – Duqm flight before Covid